How to Build a Profitable Calculator Website Like a Pro (Earn $50k+)

In the ever-evolving digital landscape, niche websites have emerged as powerful tools for generating passive income. One such example is a simple yet highly profitable calculator website . These websites not only attract massive organic traffic but also generate substantial revenue through platforms like Google AdSense. In this article, we’ll explore how you can replicate the success of a high-traffic calculator website that earns over $50,000 annually by capturing just 1% of its traffic value. We’ll also provide step-by-step guidance on creating your own calculator website using AI tools, Blogger, or WordPress.

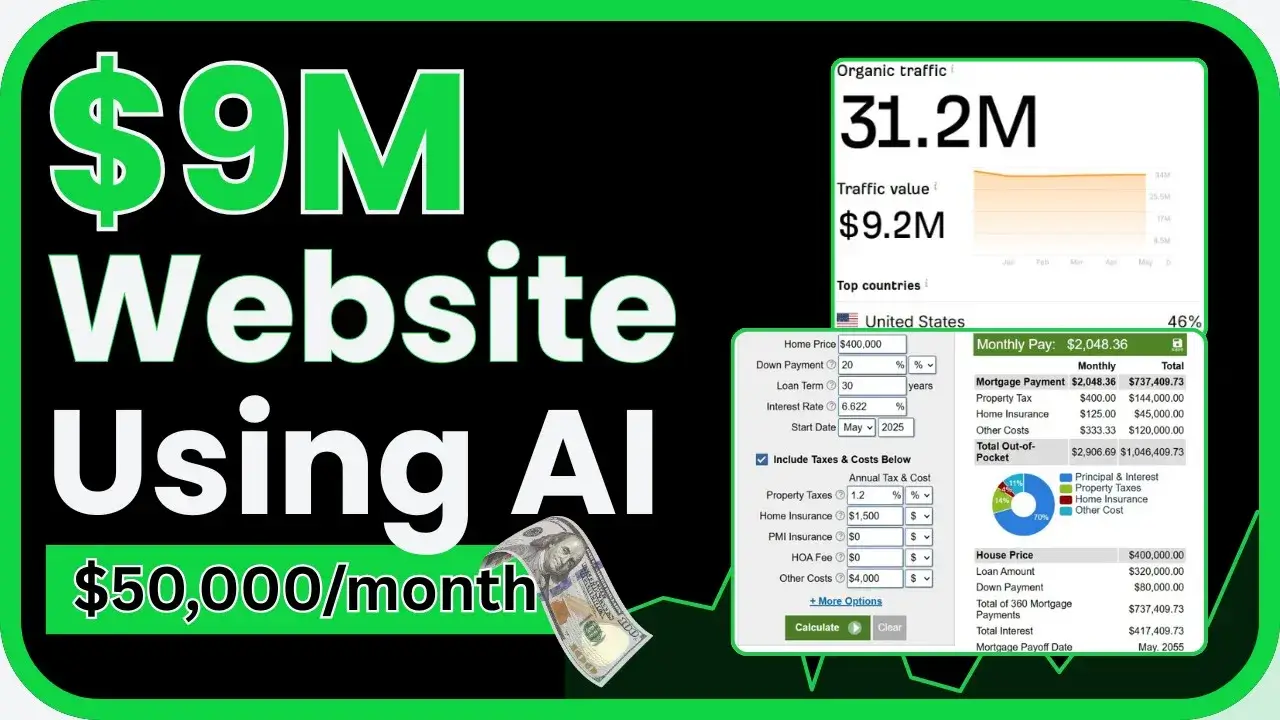

The Power of Calculator Websites

The transcript highlights a stunning example of a calculator website that generates 30 million+ organic visits per year , with a traffic value exceeding $9.2 million . Out of this, the website earns approximately $5 million annually via AdSense . Even if you manage to capture just 1% of its traffic , you could earn $50,000 or more .

Why Are Calculator Websites So Successful?

- High Demand: People constantly search for tools to simplify calculations, whether it’s for loans, taxes, or daily math problems.

- Global Audience: Calculator websites attract users from diverse regions, including the United States (46%), India, the United Kingdom, Canada, and Australia.

- Monetization Potential: With high traffic comes lucrative ad revenue, especially when targeting countries with higher ad rates like the U.S.

Step-by-Step Guide to Building Your Calculator Website

Step 1: Analyze Competitors and Identify Opportunities

Before diving in, study successful calculator websites. Use tools like HF Traffic Checker to analyze their traffic sources and earning potential. For instance, the website in the transcript gets 46% of its traffic from the U.S. , which contributes significantly to its revenue.

Step 2: Choose Your Platform

You can build your calculator website using free platforms like Blogger or WordPress . Both are beginner-friendly and require no coding knowledge.

- Blogger: Ideal for quick setups and free hosting.

- WordPress: Offers more customization options and scalability.

Step 3: Generate AI-Powered Calculators

Leverage AI tools like DeepSeek to clone existing calculators and generate inline JavaScript code. Here’s how:

- Copy the URL of the calculator page you want to replicate.

- Paste it into DeepSeek and request an AI-generated code optimized for either Blogger or WordPress.

- Copy the generated code and paste it into your blog editor’s HTML view.

Step 4: Optimize for SEO

To rank your calculator pages on Google, ensure they include:

- SEO-Friendly Titles: Use descriptive titles like “Auto Loan Calculator” or “BMI Calculator.”

- Keyword-Rich Content: Write detailed explanations about how to use the calculator.

- Internal Linking: Link related calculators to improve navigation and dwell time.

Step 5: Publish and Promote

Once your calculator pages are live, promote them through social media, forums, and guest blogging. Focus on driving organic traffic to maximize AdSense earnings.

Monetization Strategies for Your Calculator Website

- Google AdSense: Place ads strategically within your calculator interface to earn revenue per click.

- Affiliate Marketing: Partner with financial institutions or software providers to recommend products related to your calculators.

- Sponsored Content: Collaborate with brands looking to reach your audience.

- Premium Features: Offer advanced versions of your calculators as paid tools.

Case Study: Replicating Success

Let’s revisit the case study from the transcript. By targeting just 1% of the competitor’s traffic , you can achieve:

- Monthly Earnings: ~$4,167 ($50,000 / 12 months).

- Yearly Revenue: $50,000+.

This proves that even a small slice of high-value traffic can lead to significant profits.

Tools and Resources You’ll Need

- Traffic Analysis Tools: HF Traffic Checker, SimilarWeb.

- AI Code Generators: DeepSeek, ChatGPT.

- Website Builders: Blogger, WordPress.

- Free Hosting Providers: InfinityFree for WordPress.

Conclusion: Start Your Journey Today

Building a calculator website is easier than ever, thanks to AI tools and free platforms like Blogger and WordPress. By following the steps outlined above, you can create a high-traffic website capable of generating $50,000 or more annually . Whether you’re a beginner or an experienced developer, this strategy offers immense potential for passive income.

So, why wait? Dive into the world of calculator websites and unlock your earning potential today!

Prompts and Sample Code

Prompt:

Blogger Prompt

https://www.calculator.net/auto-loan-calculator.html This is Auto Loan Calculator page where we can calculate the loan for Auto. Have a look at the page carefully and clone the functionality of the page into javascript code. It should be total inline code that I can directly paste into my blogger blog. This should be 100% working code with a nice design and you also need to write SEO optimized text blow the calculator as you see on this page to rank higher on search engine!!

WordPress Prompt

https://www.calculator.net/auto-loan-calculator.html This is Auto Loan Calculator page where we can calculate the loan for Auto. Have a look at the page carefully and clone the functionality of the page into javascript code. It should be total inline code that I can directly paste into my WordPress Gutenburg Editor. This should be 100% working code with a nice design and you also need to write SEO optimized text blow the calculator as you see on this page to rank higher on search engine!!

Working Code

<div class="auto-loan-calculator-container">

<h2>Auto Loan Calculator</h2>

<p>Estimate your monthly car payment and total loan cost with our free auto loan calculator.</p>

<div class="calculator-form">

<div class="form-group">

<label for="vehiclePrice">Vehicle Price ($):</label>

<input type="number" id="vehiclePrice" value="25000" class="form-control">

</div>

<div class="form-group">

<label for="downPayment">Down Payment ($):</label>

<input type="number" id="downPayment" value="5000" class="form-control">

</div>

<div class="form-group">

<label for="tradeInValue">Trade-In Value ($):</label>

<input type="number" id="tradeInValue" value="0" class="form-control">

</div>

<div class="form-group">

<label for="interestRate">Interest Rate (%):</label>

<input type="number" id="interestRate" value="4.5" step="0.01" class="form-control">

</div>

<div class="form-group">

<label for="loanTerm">Loan Term (months):</label>

<select id="loanTerm" class="form-control">

<option value="24">24 months</option>

<option value="36">36 months</option>

<option value="48" selected>48 months</option>

<option value="60">60 months</option>

<option value="72">72 months</option>

<option value="84">84 months</option>

</select>

</div>

<div class="form-group">

<label for="salesTax">Sales Tax (%):</label>

<input type="number" id="salesTax" value="6" step="0.01" class="form-control">

</div>

<button id="calculateBtn" class="calculate-button">Calculate</button>

<button id="resetBtn" class="reset-button">Reset</button>

</div>

<div class="results-container" id="results" style="display: none;">

<h3>Loan Summary</h3>

<div class="result-row">

<span class="result-label">Monthly Payment:</span>

<span class="result-value" id="monthlyPayment">$0.00</span>

</div>

<div class="result-row">

<span class="result-label">Total Interest:</span>

<span class="result-value" id="totalInterest">$0.00</span>

</div>

<div class="result-row">

<span class="result-label">Total Cost of Loan:</span>

<span class="result-value" id="totalCost">$0.00</span>

</div>

<div class="result-row">

<span class="result-label">Total Vehicle Cost:</span>

<span class="result-value" id="totalVehicleCost">$0.00</span>

</div>

</div>

<div class="amortization-schedule" id="amortizationSchedule" style="display: none;">

<h3>Amortization Schedule</h3>

<div class="schedule-container">

<table>

<thead>

<tr>

<th>Month</th>

<th>Payment</th>

<th>Principal</th>

<th>Interest</th>

<th>Remaining Balance</th>

</tr>

</thead>

<tbody id="scheduleBody">

</tbody>

</table>

</div>

</div>

</div>

<style>

.auto-loan-calculator-container {

font-family: Arial, sans-serif;

max-width: 800px;

margin: 0 auto;

padding: 20px;

background-color: #f9f9f9;

border-radius: 8px;

box-shadow: 0 2px 10px rgba(0,0,0,0.1);

}

.auto-loan-calculator-container h2 {

color: #2c3e50;

text-align: center;

margin-bottom: 15px;

}

.auto-loan-calculator-container p {

text-align: center;

color: #666;

margin-bottom: 25px;

}

.calculator-form {

display: grid;

grid-template-columns: 1fr 1fr;

gap: 15px;

}

.form-group {

margin-bottom: 15px;

}

.form-group label {

display: block;

margin-bottom: 5px;

font-weight: bold;

color: #444;

}

.form-control {

width: 100%;

padding: 10px;

border: 1px solid #ddd;

border-radius: 4px;

font-size: 16px;

}

.calculate-button, .reset-button {

padding: 12px 20px;

border: none;

border-radius: 4px;

font-size: 16px;

cursor: pointer;

transition: background-color 0.3s;

}

.calculate-button {

background-color: #3498db;

color: white;

}

.calculate-button:hover {

background-color: #2980b9;

}

.reset-button {

background-color: #e74c3c;

color: white;

}

.reset-button:hover {

background-color: #c0392b;

}

.results-container {

margin-top: 30px;

padding: 20px;

background-color: #fff;

border-radius: 8px;

box-shadow: 0 1px 3px rgba(0,0,0,0.1);

}

.results-container h3 {

color: #2c3e50;

margin-top: 0;

border-bottom: 1px solid #eee;

padding-bottom: 10px;

}

.result-row {

display: flex;

justify-content: space-between;

padding: 10px 0;

border-bottom: 1px solid #f0f0f0;

}

.result-label {

font-weight: bold;

color: #444;

}

.result-value {

color: #2c3e50;

font-weight: bold;

}

.amortization-schedule {

margin-top: 30px;

}

.amortization-schedule h3 {

color: #2c3e50;

margin-bottom: 15px;

}

table {

width: 100%;

border-collapse: collapse;

margin-top: 15px;

}

th, td {

padding: 12px;

text-align: left;

border-bottom: 1px solid #ddd;

}

th {

background-color: #f2f2f2;

font-weight: bold;

}

tr:nth-child(even) {

background-color: #f9f9f9;

}

@media (max-width: 768px) {

.calculator-form {

grid-template-columns: 1fr;

}

}

</style>

<script>

document.addEventListener('DOMContentLoaded', function() {

const calculateBtn = document.getElementById('calculateBtn');

const resetBtn = document.getElementById('resetBtn');

calculateBtn.addEventListener('click', calculateLoan);

resetBtn.addEventListener('click', resetCalculator);

function calculateLoan() {

// Get input values

const vehiclePrice = parseFloat(document.getElementById('vehiclePrice').value) || 0;

const downPayment = parseFloat(document.getElementById('downPayment').value) || 0;

const tradeInValue = parseFloat(document.getElementById('tradeInValue').value) || 0;

const interestRate = parseFloat(document.getElementById('interestRate').value) || 0;

const loanTerm = parseInt(document.getElementById('loanTerm').value) || 48;

const salesTax = parseFloat(document.getElementById('salesTax').value) || 0;

// Calculate loan amount

const totalDownPayment = downPayment + tradeInValue;

const subtotal = vehiclePrice - totalDownPayment;

const taxAmount = subtotal * (salesTax / 100);

const loanAmount = subtotal + taxAmount;

// Monthly interest rate

const monthlyRate = (interestRate / 100) / 12;

// Calculate monthly payment

const monthlyPayment = (loanAmount * monthlyRate) / (1 - Math.pow(1 + monthlyRate, -loanTerm));

// Calculate total costs

const totalPayment = monthlyPayment * loanTerm;

const totalInterest = totalPayment - loanAmount;

const totalCost = vehiclePrice + taxAmount + totalInterest;

// Display results

document.getElementById('monthlyPayment').textContent = '$' + monthlyPayment.toFixed(2);

document.getElementById('totalInterest').textContent = '$' + totalInterest.toFixed(2);

document.getElementById('totalCost').textContent = '$' + totalPayment.toFixed(2);

document.getElementById('totalVehicleCost').textContent = '$' + totalCost.toFixed(2);

document.getElementById('results').style.display = 'block';

// Generate amortization schedule

generateAmortizationSchedule(loanAmount, monthlyPayment, monthlyRate, loanTerm);

}

function generateAmortizationSchedule(principal, monthlyPayment, monthlyRate, term) {

let balance = principal;

let scheduleHTML = '';

for (let month = 1; month <= term; month++) {

const interestPayment = balance * monthlyRate;

const principalPayment = monthlyPayment - interestPayment;

balance -= principalPayment;

// Fix potential rounding errors in final month

if (month === term) {

balance = 0;

}

scheduleHTML += `

<tr>

<td>${month}</td>

<td>$${monthlyPayment.toFixed(2)}</td>

<td>$${principalPayment.toFixed(2)}</td>

<td>$${interestPayment.toFixed(2)}</td>

<td>$${balance > 0 ? balance.toFixed(2) : '0.00'}</td>

</tr>

`;

}

document.getElementById('scheduleBody').innerHTML = scheduleHTML;

document.getElementById('amortizationSchedule').style.display = 'block';

}

function resetCalculator() {

document.getElementById('vehiclePrice').value = '25000';

document.getElementById('downPayment').value = '5000';

document.getElementById('tradeInValue').value = '0';

document.getElementById('interestRate').value = '4.5';

document.getElementById('loanTerm').value = '48';

document.getElementById('salesTax').value = '6';

document.getElementById('results').style.display = 'none';

document.getElementById('amortizationSchedule').style.display = 'none';

}

});

</script>

<h2>Understanding Auto Loans: A Comprehensive Guide</h2>

<p>When purchasing a vehicle, most buyers rely on auto loans to finance their purchase. Our auto loan calculator helps you estimate your monthly payments and understand the total cost of your loan before you visit the dealership.</p>

<h3>How Auto Loans Work</h3>

<p>An auto loan is a secured loan where the vehicle serves as collateral. You borrow money from a lender (bank, credit union, or dealership) and agree to pay it back with interest over a set period, typically 36 to 72 months.</p>

<h3>Key Factors Affecting Your Auto Loan</h3>

<ul>

<li><strong>Loan Amount:</strong> The total amount borrowed after subtracting your down payment and trade-in value.</li>

<li><strong>Interest Rate:</strong> The cost of borrowing money, expressed as a percentage. Rates vary based on credit score, loan term, and market conditions.</li>

<li><strong>Loan Term:</strong> The repayment period (in months). Longer terms mean lower payments but higher total interest.</li>

<li><strong>Down Payment:</strong> The initial amount paid upfront, which reduces your loan amount.</li>

<li><strong>Trade-In Value:</strong> The value of your current vehicle applied toward the new purchase.</li>

</ul>

<h3>Tips for Getting the Best Auto Loan</h3>

<ol>

<li><strong>Check Your Credit Score:</strong> Higher scores qualify for lower interest rates.</li>

<li><strong>Shop Around:</strong> Compare rates from multiple lenders before visiting the dealership.</li>

<li><strong>Consider Shorter Terms:</strong> While monthly payments are higher, you'll pay less interest overall.</li>

<li><strong>Make a Substantial Down Payment:</strong> Aim for at least 20% to avoid being "upside down" on your loan.</li>

<li><strong>Understand All Fees:</strong> Look out for origination fees, documentation fees, and prepayment penalties.</li>

</ol>

<h3>New vs. Used Car Loans</h3>

<p>New cars typically qualify for lower interest rates but depreciate faster. Used car loans often have slightly higher rates but can be more economical overall due to lower purchase prices.</p>

<h3>Leasing vs. Buying</h3>

<p>Leasing offers lower monthly payments but no ownership at the end. Buying builds equity and offers no mileage restrictions. Use our calculator to compare both options.</p>

<h2>Frequently Asked Questions</h2>

<h3>What is a good interest rate for an auto loan?</h3>

<p>As of 2023, rates typically range from 3% to 10% depending on creditworthiness. Excellent credit (720+) can secure rates under 4%, while subprime borrowers may pay 10% or higher.</p>

<h3>How much car can I afford?</h3>

<p>A general rule is that your total monthly vehicle expenses (payment, insurance, fuel, maintenance) shouldn't exceed 15-20% of your take-home pay.</p>

<h3>Should I finance through a dealership or bank?</h3>

<p>Dealerships may offer manufacturer incentives, but banks/credit unions often have lower rates. Get pre-approved before visiting the dealer to compare options.</p>

<h3>How does a trade-in affect my loan?</h3>

<p>Your trade-in value reduces the amount you need to finance, potentially lowering both your monthly payment and total interest paid.</p>

<h3>Can I refinance my auto loan?</h3>

<p>Yes, if interest rates drop or your credit improves, refinancing can lower your payment or shorten your term.</p>

<p>Use our auto loan calculator to experiment with different scenarios and find the financing option that best fits your budget and financial goals.</p>Additional Tips for Success

- Focus on User Experience: Ensure your calculators are intuitive and fast-loading.

- Diversify Your Offerings: Add unique calculators tailored to specific niches (e.g., health, finance, education).

- Regular Updates: Keep your website fresh by adding new calculators and improving existing ones.

By implementing these strategies, you’ll be well on your way to building a profitable calculator website. Remember, consistency and innovation are key to standing out in this competitive space.

If you found this guide helpful, don’t forget to subscribe to our channel and hit the like button. For personalized assistance or to develop a custom calculator website, feel free to contact us directly. Let’s turn your ideas into reality!